Chapter 4Markov Chain Monte Carlo and Regression Models

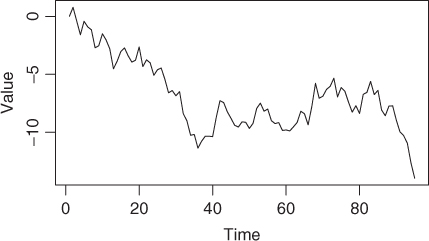

In the previous chapter, we used Monte Carlo simulation to estimate quantities of interest. The values arising from Monte Carlo simulations were completely independent from sample to sample across the simulation run. In this chapter, we introduce the idea of Markov chains. Markov chains are sequences in which each sample is generated independently, but overall the samples may be correlated or dependent across the run. Perhaps the most famous kind of Markov chain is the random walk (Figure 4.1). The dependence across time is visible in the figure even though each move has been generated independently. We can use the behavior of a Markov chain inside of a Monte Carlo simulation, and it turns out this is very useful for Bayesian statistics.

Figure 4.1 Example of a Random Walk

4.1 Introduction to Markov Chain Monte Carlo

In Chapter 3, we obtained the posterior distributions of model parameters through conjugate analysis. To obtain numerical summary statistics, we performed Monte Carlo simulations from these distributions. These simulation runs had the property of independence across iterations since each individual simulated value was an independent random draw from the parameter's posterior distribution. The Monte Carlo methods we have used so far have at least three attractive properties. First, they are extremely fast ...

Get Bayesian Methods for Management and Business: Pragmatic Solutions for Real Problems now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.