Preface

As battle‐scarred survivors of a financial crisis and deep recession, community bankers today confront a frustratingly slow recovery, stiff competition from larger banks and other financial institutions, and the responsibility of complying with new and existing regulations. Some observers have worried that these obstacles—particularly complying with regulations—may prove insurmountable.

–Ben Bernanke, chairman, board of governors of the Federal Reserve System

We Have Become Enslaved by Fintech Content

Today's bankers get so much help. A constant bombardment of LinkedIn articles, blog posts, tweets, podcasts, books(!), reports from big and small consulting firms, conferences, private discussion forums and tweet‐ups, and, of course, an incessant barrage of regulation updates.

The help/noise would overwhelm any banker, if the content of the cacophony hadn't already done so.

Flippant conference panel conjecture, medium expositions on what's happening or what's not happening, limited sample set surveys, and otherwise poorly researched analysis clog the analytical filter of even the most engaged banker.

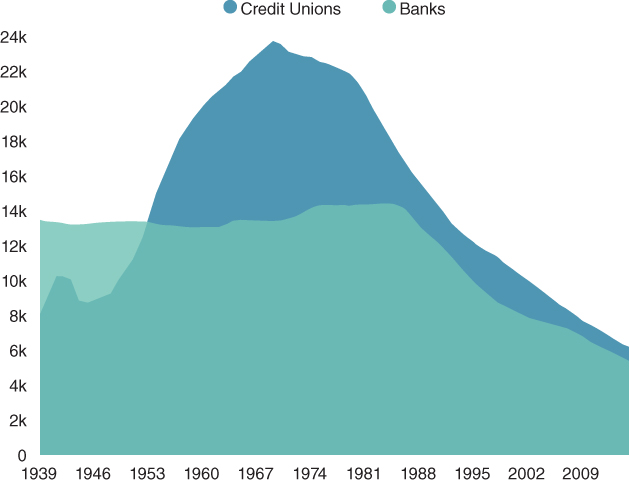

Figure P.1 The Number of Financial Institutions in the United States by Type

SOURCE: CUNA and FDICThe number of banks and credit unions has dropped significantly over the past 35 years.

One day, peer to peer (excuse me, marketplace) lending is going to transform how ...

Get Bankruption now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.