The put option

A put option is a right to sell a bond at a price fixed today with delivery in the future (Figure 17.3).

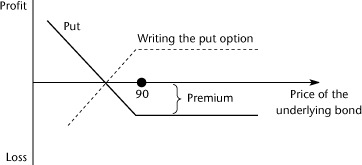

Figure 17.3. A put option

On the left side of the exercise price of 90, the bond price goes down and the put option is exercised. On the right side of the graph, the bond price increases to over 90 and the option is not exercised. In that case, the only loss will be the premium paid to buy the option.

Note that for the party selling (writing) the put, the payoff scheme (dashed line) is completely different. The writer of the put keeps the premium if the option is not exercised. If it is exercised, it could end up with very ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.