Forward contracts

For many years, banks have used forward contracts to hedge a risk or to take a position.

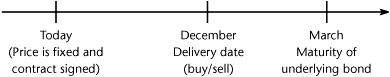

A forward is an agreement between two parties to sell a financial instrument (a share, currency, bond) at a future date (the delivery date) at a predetermined price.

ExampleFor instance, let us imagine a contract signed in September between e-Bank and Alpha Bank: e-Bank agrees to buy a 3-month-to-maturity treasury bill next December at a price of 90 fixed today.

It is an off-balance sheet transaction as it is just an agreement between two parties. As discussed in Stage 1, it has no impact on assets and liabilities (the very small transaction ... |

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.