The securitization process

Securitization involves the sale of loans to investors. These may be individuals or institutional investors such as pension funds, life insurance companies or other banks.

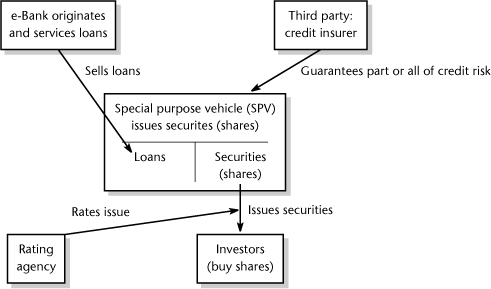

As a potential investor, your uncle is very worried about the quality of the loan sold by e-Bank. So, to reassure him about the quality of his investment, you explain to him that two additional parties are involved in securitization: a credit risk insurer and a rating agency. The general mechanism of securitization is given in Figure 10.1.

Figure 10.1. How securitization works

The sale of loans to investors is made through a special corporate entity ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.