BIS capital

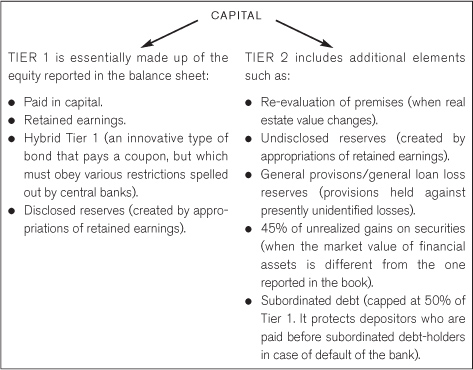

As banks were concerned with their leverage driver, they lobbied very hard to have a measure of capital that would not include too much equity. In 1988, the negotiations came to an end with a measure of capital composed of two parts: Tier 1 (at least 4%) and Tier 2.

The Basel Committee has imposed a minimum capital requirement that must be met by international banks. Each national central bank can adopt a more stringent regulation. On strict legal grounds, the Basel Committee has no authority to enforce the capital regulation, but its moral authority is such that no central bank would dare to adopt a more lenient capital regulation. ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.