The case of loans

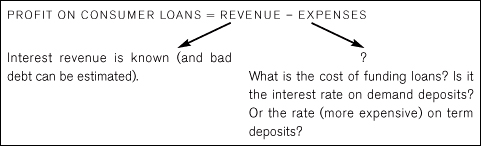

Just as you did for deposits, you want to measure the profitability of the consumer loans granted by the branch. According to standard accounting:

In the case of loans, the revenue is known, but the funding cost needs to be estimated. Again, we will focus on the impact on the balance sheet of e-Bank of expanding or reducing the loan portfolio.

As is the case for deposits, changes in loan portfolios are managed through the interbank position. An increase in loans will be funded by a decrease in the interbank position, while a decrease in loans will imply an increase in the interbank position.

If a change in the volume of loans ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.