Shareholders’ investment opportunities

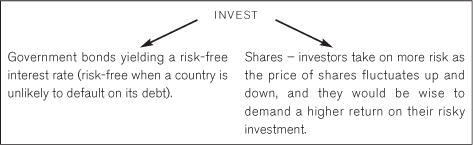

The two types of investment opportunities available to your sister and other shareholders include:

The difference between the expected return on a risky share and the risk-free rate on government bonds is called the risk premium.

In other words, the expected return on a bank share will be equal to the current interest rate on bonds plus a risk premium.

Expected return on a bank share = Risk-free rate on bonds + risk premium

The expected return on a share is sometimes referred to as the average return. As the share price goes up and down, the return on your investment can be high or low. The expected return ...

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.