Solution to Stage Eight

| 1. |

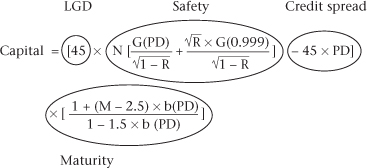

Capital for a loan of 100 = (LGD × safety – LGD × PD) × maturity The table, capital required for credit risk, reports the required capital and the components of the formula for a loan of $100. Required capital: $9.19 Safety: 19.03% Credit spread: $45 × 2% = $0.90 Maturity adjustment: 1.2

| ||||||||

| 2. | The safety factor, 19.03%, represents ... |

Get Asset and Liability Management: The Banker’s Guide to Value Creation and Risk Control, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.