Chapter 131SECURITISATION MECHANICS FOR BALANCE SHEET MANAGEMENT

Securitisation is a financing technique that involves the conversion of certain types of assets with predictable cash flows into marketable securities. Generally speaking, it is the process of creating securities backed by pools of assets that are then sold to institutional investors. The conversion process usually involves a special purpose vehicle (SPV) whose only purpose is to buy assets and raise funding through issuance of asset‐backed securities (“ABS”).

Other short‐term methods of financing utilising securitisation technology are available. In the case of mortgages it is known as warehousing (as it is only short term); this is usually financed either on a balance sheet or using asset‐backed commercial paper (ABCP financing).

Banks and other financial institutions undertake securitisation as a means of raising long‐term funding, diversifying the funding base, freeing up balance sheet capacity, and, in some instances, also to achieve a regulatory capital benefit through the transfer of credit risk to another party.

THE PARTIES TO A SECURITISATION

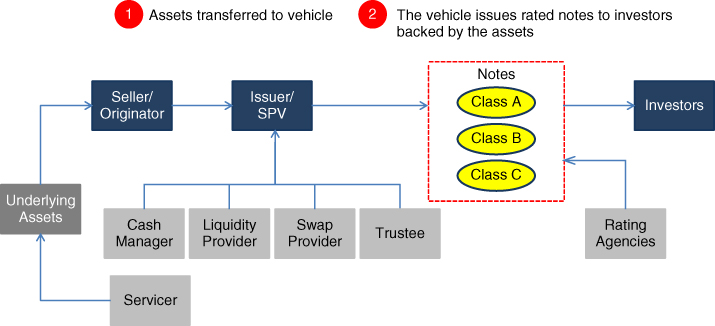

Figure 13.1 illustrates a vanilla securitisation structure and the various parties involved; the roles performed by each are discussed in more detail below.

Figure 13.1 Vanilla securitisation structure

Underlying assets: These can be any assets with a predictable ...

Get An Introduction to Banking, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.