APPENDIX: TAYLOR'S EXPANSION

![]()

Taylor's Expansion is an important technique in mathematics and was used by Frederick Macaulay when he developed the duration concept for bonds. It was also used by Black and Scholes when they formulated their option pricing model. Latterly, it has been used in developing the delta–gamma approximation for value-at-risk (VaR) measurement.

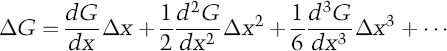

Taylor's Expansion is given by:

This is, in effect, a calculus differentiation. The first term is the first derivative and can be viewed as the duration of a bond, derived from the price formula. The second term is the second derivative, which is what convexity is in relation to the bond price formula. The third term has little practical impact because it is materially insignificant, so in financial markets it is not considered.

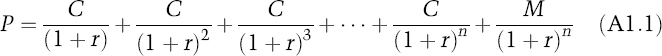

Applying Taylor's Expansion enables us to derive the duration and convexity formulae from the bond price equation. The price of abond is the present value of all its cash flows, discounted at the appropriate internal rate of return (which becomes the yield to maturity). It is given by:

assuming complete years to maturity paying annual coupons, and with no accrued interest at the calculation date. ...

Get An Introduction to Value-At-Risk, Fourth Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.