CHAPTER 2

The Basics of Mean Reversion

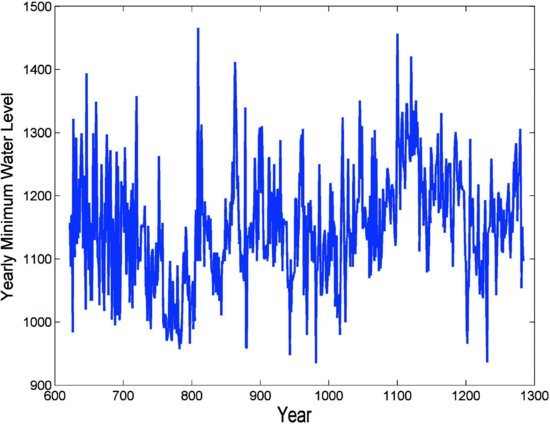

Whether we realize it or not, nature is filled with examples of mean reversion. Figure 2.1 shows the water level of the Nile from 622 ad to 1284 ad, clearly a mean-reverting time series. Mean reversion is equally prevalent in the social sciences. Daniel Kahneman cited a famous example: the “Sports Illustrated jinx,” which is the claim that “an athlete whose picture appears on the cover of the magazine is doomed to perform poorly the following season” (Kahneman, 2011). The scientific reason is that an athlete's performance can be thought of as randomly distributed around a mean, so an exceptionally good performance one year (which puts the athlete on the cover of Sports Illustrated) is very likely to be followed by performances that are closer to the average.

FIGURE 2.1 Minimum Water Levels of the Nile River, 622–1284 AD

Is mean reversion also prevalent in financial price series? If so, our lives as traders would be very simple and profitable! All we need to do is to buy low (when the price is below the mean), wait for reversion to the mean price, and then sell at this higher price, all day long. Alas, most price series are not mean reverting, but are geometric random walks. The returns, not the prices, are the ones that usually randomly distribute around a mean of zero. Unfortunately, we cannot trade on the mean reversion of returns. (One ...

Get Algorithmic Trading: Winning Strategies and Their Rationale now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.