Chapter 6Exchange, Spread, and Quanto Options in Commodity Markets

‘All models are wrong, but some are useful.’

2010 – George Box, An Accidental Statistician

6.1 Exchange Options

Exchange options, in the form of real options, have existed for ever in the world of commodities: the exchange was called barter. In the form of financial instruments, exchange options have existed for many decades in equity markets since the mid-1970s for investment purposes: by holding the stock S2 and an option to exchange the stock S2 for another S1, an investor gets at maturity the best of the two stocks S1 and S2, which is obviously a desirable position for all investors.

The payoff at maturity T of an exchange option is:

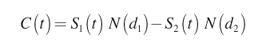

Margrabe (1978) provided in the Black–Scholes–Merton setting an exact pricing formula that has the remarkably symmetric form:

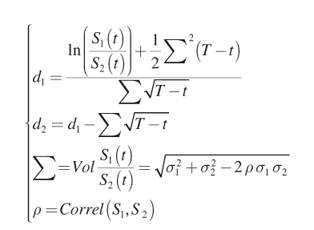

where:

The proof can be obtained through a partial differential equation analogous to the Black–Scholes one or by computing the discounted expectation under the pricing measure of the final payoff.

Turning to commodities and assuming the dynamics of their prices driven by geometric Brownian motions, we have seen that under the pricing measure Q, the processes ...

Get Agricultural Finance: From Crops to Land, Water and Infrastructure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.