Chapter 5Commodity Swaps, Swaptions, Accumulators, Forward-Start, and Asian Options

‘Everything should be made as simple as possible, but not simpler.’

Albert Einstein

5.1 Swaps and Swaptions

Swaps in commodity markets have the same definition as in the interest rates markets and are nothing but a portfolio of forward contracts entered at the same price.

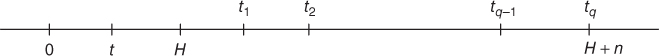

As usual, the current date is being denoted as t and the period covered by the swap is (H,H+n years) where H is a future date, H>t; n is typically an integer but may be a fraction of a year:

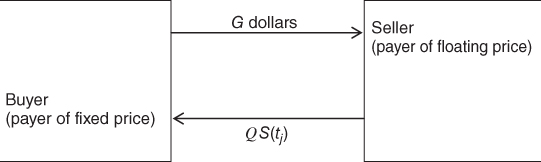

On the dates t1, t2,…, tq=H+n years, which are usually equally spaced (e.g., quarterly, monthly), the buyer of the swap pays a fixed amount of G dollars – G is the guaranteed price of the swap – corresponding to a well-defined quantity A of the commodity underlying the swap contract:

On the same date tj, the seller of the swap pays the amount QS(tj), where Q is the number of tonnes of wheat and S(tj) denotes the spot price at date tj of a unit quantity of this commodity as reflected by a major index (e.g., Platts index in the case of crude oil); hence, the importance of reliable and liquid indices in agricultural commodities and shipping markets discussed in Chapter 1.

It is clear that if the number of cash flow exchanges reduces to one ...

Get Agricultural Finance: From Crops to Land, Water and Infrastructure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.