Solutions Manual

This Solutions Manual includes answers to all of the end of chapter problems found in this book (except for a few coding problems where the numerical answer is provided in the text).

Chapter 1: Exotic Derivatives

1.1 “Free” Option

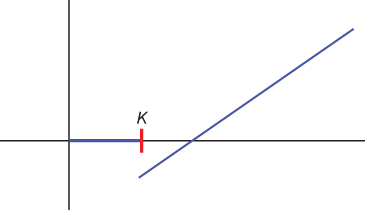

- The option is not really free because we may end up at a loss at and above the strike price. (See Figure S.1.)

- The replicating portfolio would include selling x digital calls struck at K at price p and buying a vanilla call struck at K for the premium of m. In order for the portfolio to have zero cost we must have

.

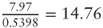

. - The cost of one digital call using the Black-Scholes model with the given parameters is $0.5398. The premium of the vanilla call from the Black-Scholes model is $7.97. Solving for x we get

.

.

Figure S.1 “Free” option payoff.

1.2 Autocallable

Answer: ![]() .

.

1.3 Geometric Asian Option

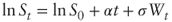

- From Ito-Doeblin we have

where α = r − q − ½σ2. Substituting into the definition of AT we get:

where α = r − q − ½σ2. Substituting into the definition of AT we get:

- which yields the required expression for A

Get Advanced Equity Derivatives: Volatility and Correlation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.