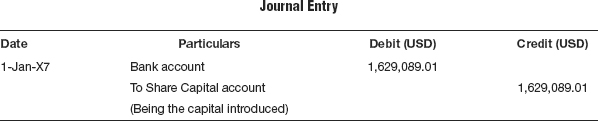

ACCOUNTING ENTRIES IN FUNCTIONAL CURRENCY—USD

F-1 On introducing cash into the fund: (T-1 @ FX Rate: 1.53)

F-2 On purchase of Bonds—available-for-sale: (T-2 @ FX Rate: 1.53)

F-3 On recording accrued interest purchased on purchase of Bond: (T-3 @ FX Rate: 1.53)

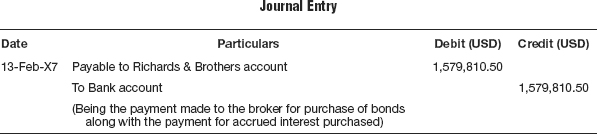

F-4 On payment of contracted sum: (T-4 @ FX Rate: 1.54)

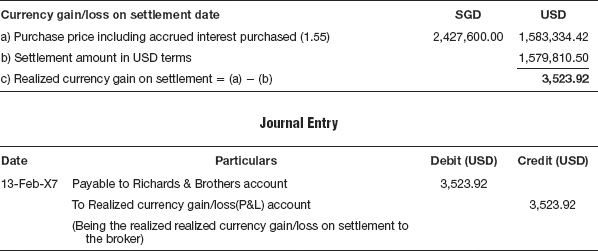

F-5 FX Translation on payment to broker:

The settlement amount when converted is the USD based on the FX rate on the date of the settlement results in a different amount than the contracted amount in USD terms. This represents the currency gain or loss and is taken directly to the profit and loss account. If this FX translation entry is not passed, then the liability account of the broker will continue to have a balance even though the broker is settled in full in the respective local currency.

Here we have a currency gain on settlement date due to FX translation:

F-6 On accounting for interest on coupon date: (T-5 @ FX Rate: 1.53)

F-7 On reversal of accrued interest purchased: ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.