Chapter 13Hedge Accounting: A Double-Edged Sword

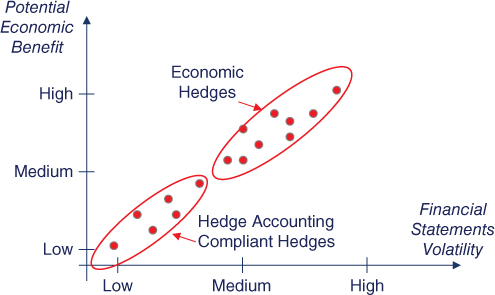

Hedge accounting is optional: it is a choice made by the management of an entity. Hedge accounting is a special accounting treatment available to ensure that the timing of profit or loss recognition on the hedging instrument matches that of the hedged item. When hedging, corporations face the decision between entering into hedge accounting compliant hedges and pure economic hedges (see Figure 13.1). At first glance, it seems a straightforward decision as the reduction in profit or loss volatility stemming from applying hedge accounting provides a powerful argument for adopting hedge accounting compliant hedges. However, in reality the decision whether or not to implement hedge accounting compliant hedges can be a difficult one: applying hedge accounting may be operationally complex and accounting compliant hedges are relatively limited (forwards/swaps and standard options).

Figure 13.1 Economic hedges versus hedge accounting compliant hedges.

The decision whether or not to adopt hedge accounting compliant hedges requires an in-depth analysis at both the entity level and the consolidated level as it may affect earnings, earnings per share, cash flows, gearing, interest cover, dividend cover, covenants, margins, bonuses and staff payment schemes. In my view it does not make sense to discard an attractive hedging strategy just ...

Get Accounting for Derivatives: Advanced Hedging under IFRS 9, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.