Chapter 9Hedging Equity Risk

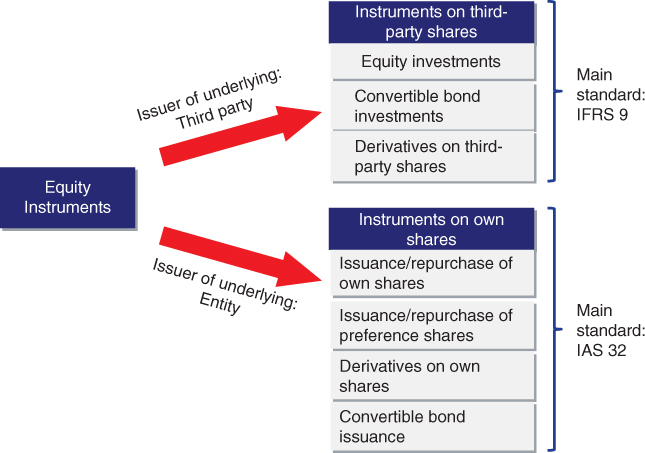

This chapter focuses on the issues affecting equity recognition and hedging. Many of the concepts outlined herein are within the scope of IFRS 9 and IAS 32 Financial Instruments: Disclosure and Presentation. Besides the hedging of equity risk of investments in other companies, this chapter also covers the accounting treatment of preference shares, derivatives on own shares and convertibles (see Figure 9.1).

Figure 9.1 Equity instruments.

9.1 RECOGNITION OF EQUITY INVESTMENTS IN OTHER COMPANIES

In this section I will refer to investments in non-structured entities (i.e., entities that have sufficient equity and provide the equity investors voting rights that enable them to make significant decisions relating to the entity's operations). An investment in equity securities of another company is recognised according to the degree of influence over the investee (see Figure 9.2) as follows:

- The group has control over the investee. Control is regarded as the power to govern the operating and financial policies of the investee so as to obtain benefits from its activities. Usually, control is presumed if the investor holds more than 50% of the voting rights of the investee. The existence and effect of potential voting rights are also considered when assessing whether the group controls the investee. Companies that are controlled by the group are usually ...

Get Accounting for Derivatives: Advanced Hedging under IFRS 9, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.