Chapter 1The Theoretical Framework – Recognition of Financial Instruments

IFRS 9 Financial Instruments is a complex standard. IFRS 9 replaced IAS 39 Financial Instruments: Recognition and Measurement. It establishes accounting principles for recognising, measuring and disclosing information about financial assets and financial liabilities. The objective of this chapter is to summarise the key aspects of financial instrument recognition under IFRS 9.

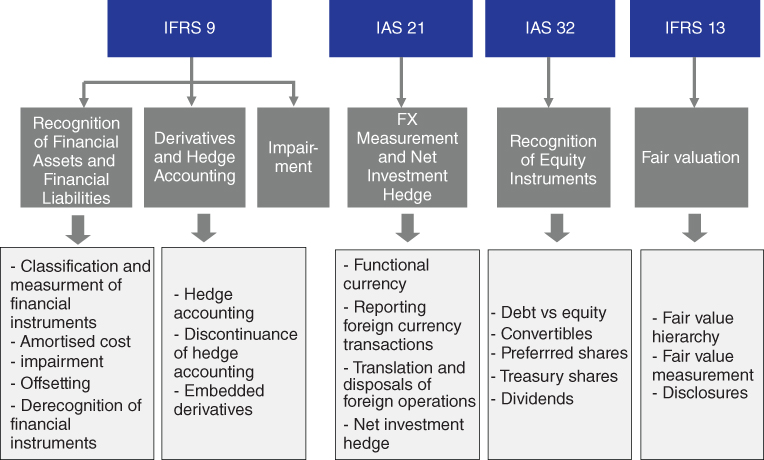

IFRS 9 is remarkably wide in scope and interacts with several other standards (see Figure 1.1). When addressing hedging there are, in addition to IFRS 9, primarily three standards that have an impact on the way a hedge is structured: IAS 21 The Effects of Changes in Foreign Exchange Rates, IAS 32 Financial Instruments: Disclosure and Presentation and IFRS 13 Fair Value Measurement.

Figure 1.1 Relevant accounting standards for hedging.

Whilst the International Accounting Standards Board (IASB) is responsible for setting the IFRS standards, jurisdictions may incorporate their own version. For example, entities in the European Union must apply the version of IFRS 9 endorsed by the EU, which might differ from the IASB's IFRS 9 standard.

1.1 ACCOUNTING CATEGORIES FOR FINANCIAL ASSETS

Under IFRS 9, a financial instrument is any contract that gives rise to both a financial asset in one entity and a financial liability or equity instrument ...

Get Accounting for Derivatives: Advanced Hedging under IFRS 9, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.