Book III

Adjusting and Closing Entries

In this book…

- Choose the best depreciation method for your long-term assets. Assets are used to generate revenue, and depreciation expenses the cost of the asset as it's used in business.

- Account for interest your business pays or receives. If your business borrows or lends money, it pays or collects interest. Either way, you need to account for that interest.

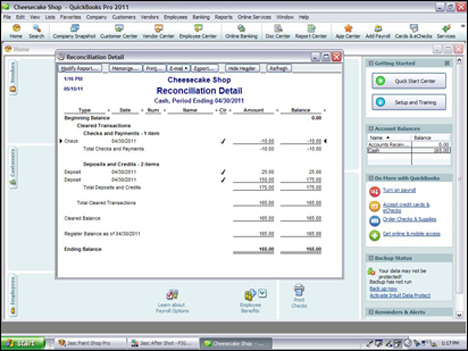

- Prove out the cash to ensure that what's on paper matches the real dollar amounts in a store or office. Your cash account typically has a lot of transactions. As a result, you need to carefully account for cash to ensure that all the activity is properly recorded.

- Reconcile accounts and confirm that your journals and general ledger are correct. Reconciling your books is a great way to check your work, correct any errors, and even spot signs of fraud!

- Double-check your books by running a trial balance, correct any errors, and prepare a financial statement worksheet. A trial balance lists all your accounts and their dollar balances.

- Adjust the books in preparation of preparing financial reports. Trial balances are adjusted before being used to create financial ...

Get Accounting All-in-One For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Check out

Check out