CHAPTER 10

Case Study 10—Saved Expenses, Bivariate Model Inadequacy, and Multiple Regression Models

Case Study 9 concerned certain operating expenses that appeared to be candidates for treatment as saved expenses, but upon further analysis were found to be unrelated to revenue. In this chapter, we continue to explore the nature of operating expenses and the procedures we need to apply in order to satisfy ourselves regarding the degree, if any, to which they can be deducted from lost revenue as saved expenses.

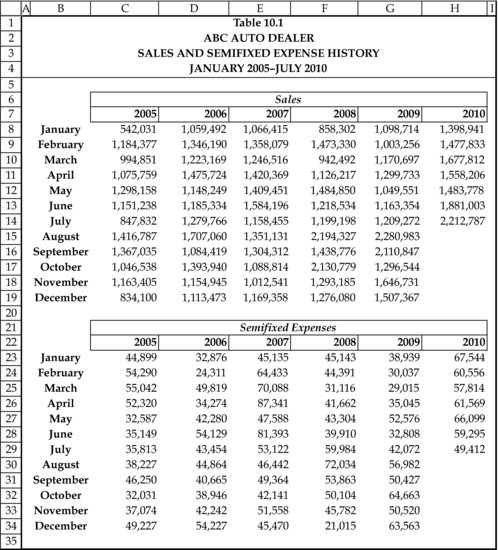

The facts of the case involve an automobile dealership that was subject to an incident in August 2010 that closed its showroom for the remainder of the month. After determining lost revenue and subtracting cost of sales and other variable costs, the remaining issue was the handling of semifixed costs, as reported on the monthly reports that the dealer sent to the manufacturer. These costs consist mainly of salaries, floor plan interest, and advertising and promotion, which categories represent 41 percent, 19 percent, and 32 percent, respectively, of the semifixed monthly and annual totals. A summary by month of sales and semifixed expenses for the period January 2005 to July 2010 is presented in Table 10.1.

Graph Your Data

To begin to answer the question of how much, if any, of the semifixed expenses are a function of sales and therefore to be deducted from lost ...

Get A Quantitative Approach to Commercial Damages: Applying Statistics to the Measurement of Lost Profits, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.