CHAPTER 18Statistical and Theoretical Concepts

This chapter provides a brief introduction to concepts in statistics and portfolio theory. We include a fair amount of math, but we do our best to avoid excessive complexity. Our intent is to establish a sufficient foundation for this book that is reasonably clear, but this review is by no means comprehensive. We therefore include references to other sources that provide a more thorough and technical explanation of these topics.

DISCRETE AND CONTINUOUS RETURNS

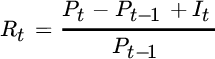

We define the discrete return ![]() for an asset from time

for an asset from time ![]() to

to ![]() as the change in price over some period plus any income generated, all divided by the price at the beginning of the period:

as the change in price over some period plus any income generated, all divided by the price at the beginning of the period:

Next, we denote the log return of the asset using a lowercase ![]() :

:

Here ![]() is the natural logarithm ...

is the natural logarithm ...

Get A Practitioner's Guide to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.