Chapter 10

The Tipping Point

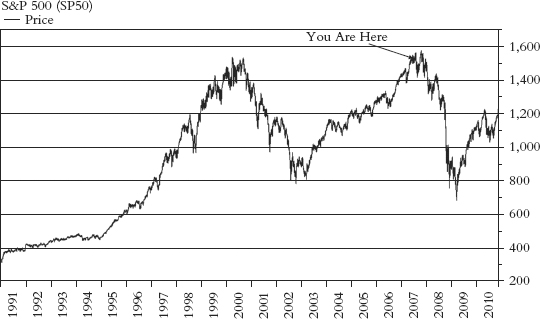

Source: © FactSet Research Systems.

Chapter 10 begins with a brief excerpt from Martin Capital’s Quarterly Capital Markets Review, July 2007, followed by the draft of a letter dated the same month in which I proposed to explain to MCM clients a potential “put option” hedging strategy. The next section, “What’s Up, Doc?,” was published as part of an ongoing sequence of Quarterly Capital Markets reviews, this one in October 2007. The chapter concludes with the 2007 annual report, published in February 2008.

When, the reader might wonder, did the vague notion that had been germinating in my mind for some time—the sum and substance of Chapter 9—about “things ending very badly” become sufficiently concrete in my thinking that I actually took action to capitalize on it?

On May 5, 2007, I was a man with a mission among an otherwise teeming throng of Buffettites, a potpourri of 25,000 mostly Berkshire Hathaway shareholders, at the Qwest Center in downtown Omaha, Nebraska. Almost as a coincidental indicator of the popularity of common stock investing since the early 1980s, the crowd had grown exponentially from the several hundred who were present when I first journeyed to Nebraska in the early 1980s to lay eyes on the man who would become my “mentor in absentia.” My attendance was sporadic in the years that followed, but I again became a regular in the late ...