Chapter 9. Balance Your Risk through Smart Asset Allocation

"The market loves teaching expensive lessons to overconfident investors."

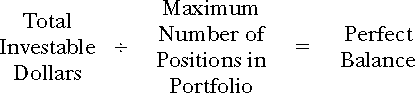

Equation 9.1.

Rule 9 is a companion rule to Rule 8. Where Rule 8 covered how to keep your portfolio diversified from a sector and industry perspective, Rule 9 covers a problem many investors have, which is how many stocks to own at any one time and how much money should be invested in each position.

Rule 9 is an amazingly simple rule, but it is extremely important for portfolio management. As a reminder, your goal is to build a world-class portfolio of stocks that will make consistent and significant profits in the stock market.

But making consistent profits in the stock market is more than just picking the right stock at the right time and/or selling the right stock at the right time. It also is about minimizing risk.

How Can I Minimize Risk While Making Profits?

Risk can be defined in many ways, but one element of risk which can and must be avoided is overweighting your stock investments by either having too few positions or putting more money into one position than you put into another.

You see, regardless of how adamant you are with your rules or how closely you stick to my 10 Essential Rules, the market will, on occasion, completely move against you and your best picks. There is no way to avoid this. It will happen just as sure as you are reading this ...

Get 10: The Essential Rules for Beating the Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.