Chapter 6. Follow Only "Some" Insider Trading

"Monitoring insider selling is a total waste of time!"

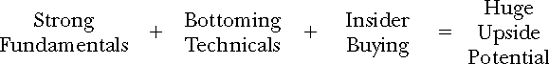

Equation 6.1.

By the time you get to this rule, you are well on your way to knowing how to find the best stocks to own, when to buy them, and when to sell them. You also know how to avoid getting emotionally attached to your stocks.

Now, it is time to start doing a little refining of your growing and evolving investment strategy. Let's move on to see what we can glean from insider trading.

In this rule, you will learn how to analyze legal insider trading and how to use the data to help you make a final, perhaps critical, decision on selecting and/or ranking the stocks that you may consider adding to your portfolio. Finding the right stock that fits all of your requirements for buying out of many thousands of stocks is truly akin to finding a needle in a haystack. We want to narrow that search down to just a handful of the best of the best. We will do that by using insider trading data, but we'll use only one very specific type of insider trading data.

What Is Insider Trading?

Insider trading is a term that most investors have heard and usually associate with illegal activities. But the term actually includes both legal and illegal conduct. The legal version is when corporate insiders—officers, directors, and employees—buy and sell stock in their own companies. When corporate insiders trade ...

Get 10: The Essential Rules for Beating the Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.